Home » Blog » Online Books » Local Payment Options

Local Payment Options

Written by

Phil Winston

As discussed in Truly Global Reach the view we have of the internet, or the book market, is coloured by our own point of view. Our way of seeing the world, as we interact with it, can blind us from the wider, more complex reality.

So while it may be easy to imagine the internet being "everywhere" on the planet as a monolithic structure, with only connection speed a variable, the ways that people in various parts of the world interact with it is more appropriate a measure. And the ways they can interact with it, is an extremely diverse and fragmented landscape of overlapping technologies.

This fragmentation can be less apparent when considering payment options, as we each simply use the ones available to us without question, and might easily imagine PayPal, Stripe and other methods are globally available. Why wouldn't they be? It's the internet! The reality however, is that payment methods are highly localised, both legally and culturally, making the ability to reach customers and trade in a way they can agree to extremely difficult.

Stripe & PayPal

While PayPal claims to be "available" in over 200 countries, the vast majority of all transactions it processes are in 5 to 6 (Germany, the UK, Australia, Canada, and the US). Its market reach drops rapidly after that to effectively end at around 45 countries globally, simply because it is not really used beyond that.

The list where it is definitely not available due to regulatory restrictions is almost as long as where it is, with almost 30 countries (mostly in Africa and Southern Asia), explicitly not permitting PayPal transactions.

We've all likely also heard of the meteoric rise of Stripe in recent years, with two Irish brothers attracting billions in investment from Silicon Valley to become one of the most valuable payment processors on the planet. But even their reach is limited, with the actual preferred methods of paying online in Europe being bank transfers. This is facilitated through systems such as Kiwi or Yandex.Money in Russia, a range of direct connections with banks in Poland, or systems like iDeal in the Netherlands. Some of these are facilitated by Stripe, but that is a landscape fragmented across websites also, with direct integrations common in order to avoid the Stripe processing fees.

Cash & P2P

South American countries have predominantly been cash based economies for a long time, but new methods have emerged recently, perhaps as a result of covid. These methods include Pix in Brazil, Yape in Peru, and Modo in Argentina, which have started to supplant cash and are now in second place as the main method of payment, both online and offline. This method is essentially a digital wallet layer which can be topped up in a number of ways, from bank transfer, card top-up, or wallet to wallet transfers between people, a balance which can then be used for instant payments across a range of digital checkouts.

Mobile Payments & Prepaid Cards

MPesa has quickly become the dominant payment method in a number of Eastern African countries. With equivalent services in offer in south and western Africa, the method is essentially a mobile phone facilitated credit transfer. An estimated 98% of the population in Kenya (including government services) use Mpesa both online and offline, and it is used by very large shares of the population in Tanzania, Uganda, Ghana and a number of others in the region. In northern African states, prepaid cards are dominant, as are bank transfers, with card payments a minor percentage of the market.

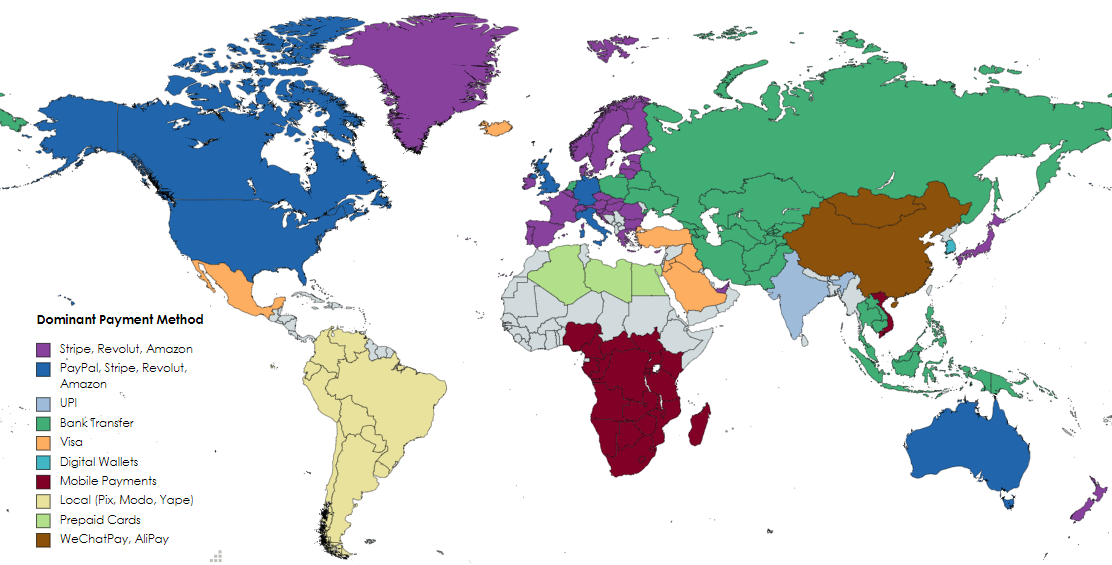

Taking even just what has been discussed so far, and it is even more detailed than this in reality, we have put together a map of this global payment landscape. This is all also before we start to consider cryptocurrencies...

To put this situation into a practical perspective with an example, if you were author in Kenya offering your book for sale on Amazon, you might first run into the problem of Amazon not having much of a presence in Kenya to start with, but also that it doesn't facilitate payment via MPesa, which your readers will certainly prefer to use to buy your book.

Similarly, making your book available on an ebook platform in India might sound like a great workaround. But will be able to register on that platform and withdraw funds if you are not resident there. You should check first, it isn't easy.

So while selling 25 books on Amazon would be great, it could have potentially been 250 through your own website, one that takes payment in MPesa, and also through a UPI gateway in India, and Stripe to reach European markets. And you'd get to keep the revenue.

The Global eBook Market

As mentioned in another post, the total global market size for eBooks is expected to increase in total revenue to US$23 Billion by 2026, with most of the growth taking place in Asia Pacific.

As also mentioned, this ideally represents an opportunity for international expansion for authors in all parts of the world. But as is now obvious, your potential customers wanting your book and being able to pay you for it, are not the same thing.

While the big ecommerce marketplaces provide an opportunity to access some markets, it is clearly far from all markets. As such, they should be used where they are valuable and provide a path to market, but not depended upon as a primary and perhaps even exclusive distribution channel.

Your reach will be limited by theirs, and a US$23 Billion global market awaits.

Opportunity Knocks

This suggests that a more direct approach could bear a greater harvest, where a "private" marketplace in the form of an author website. This website could allow you to access the wider, faster, deeper flowing river of the general internet, with links in and out from other author sites, blogs, and review sites serving as part of a bespoke marketing strategy.

Search engines are often the first place readers search for new books to read, with traffic only so far claimed by the big marketplaces.